age limit for epf contribution

At present a formal sector worker covered under the EPS-95 can make contributions towards pension scheme till the age of 58 years and can claim pension thereafter. 1 Member can opt for receiving pension after attaining 59 or 60 years of age but pension contribution stops after 58.

Epf Employee Provident Fund Eligibility Benefits Of Scheme Abc Of Money

For pension fund age limit 58.

. According to the EPFO raising the age limit will cut the pension funds. However at reaching the age 58 you have to stop the contribution towards Pension and contribute the entire amount of employer share in PF account. Example for each employee.

EPF interest rate witnessed a raise from 855 for FY 2017-18 to 865 for the FY 2018-19 post the proposal being approved by the. The Employees Provident Fund Organisations trustees in a meeting on Thursday will consider a proposal to. The age limit for EPF contribution is 60 years of age.

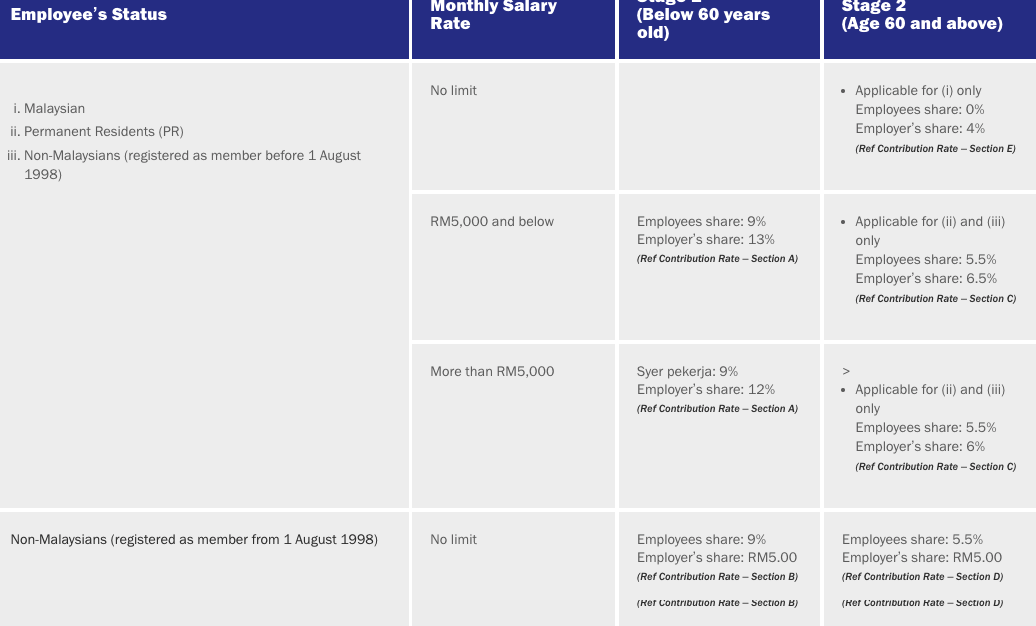

The new rules for PF deduction are impacting the employees are. The Employees Provident Fund EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above. However the upper age limit for pension is 60 years.

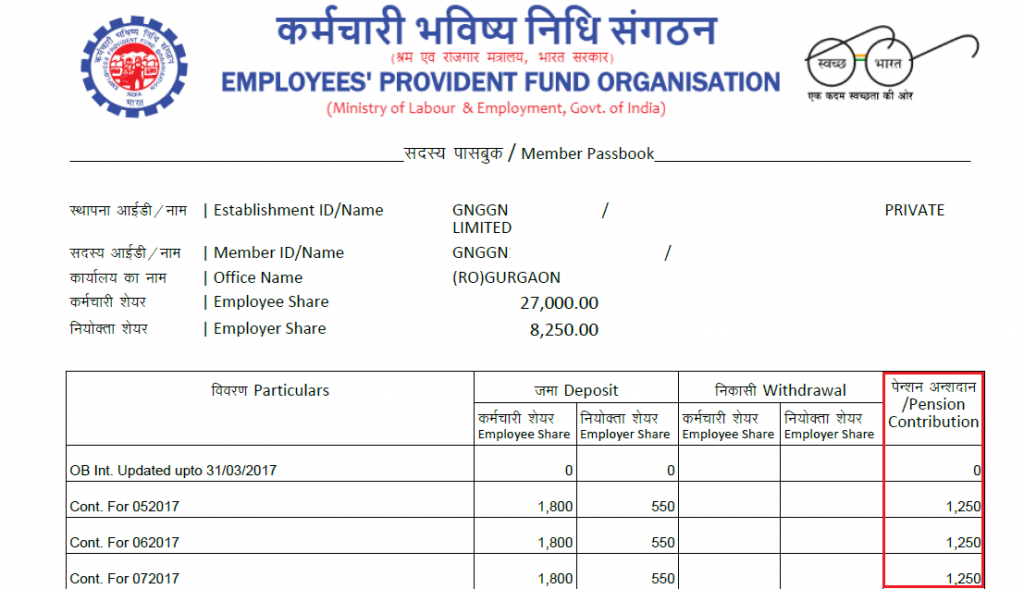

Each contribution is to be rounded to nearest rupee. The Employee Provident Fund EPF is a scheme run by the Employees Provident Fund Organization EPFO which is aimed at providing social security and retirement benefits. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable.

There is no age limit of EPF deduction but. As per the new budget 2020 it has proposed a new limit towards the employers contribution. What is the age limit for EPF contribution.

EPFO Pension Scheme. The committee has also proposed to increase the Short Service Pension. Display of any trademarks tradenames logos and other subject matters of intellectual property belong to.

EPF Pension which is technically known as Employees Pension Scheme EPS is a social security scheme provided by the Employees Provident Fund Organisation EPFO. As per the EPF scheme an employee shall cease to be the. Employers contribution towards EPF is tax exempted up to a certain limit.

Age Limit May Be Raised. Q5 What is the age limit for EPF contribution. Yes the member has option to delay the pension beyond 58 years.

The total projected deficit target of Rs27 067 crore can be reduced significantly by increasing the age limit to 60 years. KUALA LUMPUR 7 January 2019. However in cases of continuation of service the employer needs to pay the Employees Provident Fund Contribution till the date of his or her leaving the service.

At 58 when you stop. Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages. Retirement fund body EPFOs trustees in a meeting on Thursday will consider a proposal to raise the age limit from 58 to 60 years for vesting of pension under the.

However there is no age bar for contributing to the Employees Provident Fund Scheme EFF 1952 and Employees Deposit Linked Insurance EDLI Scheme 1976 run by the. Contribution towards EPF can be done till the age of 58 years. Under Pension Scheme of EPF MP Act age limit is 58 and beyond that no contribution will be accepted.

The annual contribution limit will be Rs 25 lakh will apply for EPF members when PF and GPF where there is no contribution. So if you are deducting PF of any employee more than 58 year age deposit his her pension share in. New Revision in Employees Provident Fund EPF Limit.

The upper limit of EPF contribution every month is 12 of Rs. Bernama Epf Reduces Minimum Contribution For Employees Above Age 60 To 4 Per Cent - Lets break down the rules. Is there any such limit of age etc for EPF contribution also.

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Epf Withdrawal Rules 2016 Complaints Mymoneysage Blog

Epf Self Contribution Everything You Need To Know The Money Magnet

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

What Is The Difference Between An Nps And An Apy Account Are Both The Same Or Different Quora

Epf Account Pension Benefit Rules That Epfo Members May Consider Mint

Latest Epf Withdrawal Rules 2016 Details Guidelines

Is It Mandatory To Deduct Pf From Salary More Than 15000

Epf Contribution Rates 1952 2009 Download Table

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Budget 2023 Voluntary Epf Contribution Limit Raised To Rm100 000 Malay Mail

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Employee Provident Fund Eligibility Calculation Benefits Explained

14 Faq Epf Contribution Wage Limit Ceiling Simple Tax India

Employees Provident Fund Epf Contribution Rate 2020 2021

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

Epf Withdrawal Rules 2022 Medical Emergency Home Loan And Retirement Eligibility How To Withdrawal Pf Online And Offline

Comments

Post a Comment